COST, VALUE, AND RISK

A protocol to evaluate impacts of energy and non-energy benefits associated with deep renovation on the financial value and risks of office and hotel buildings. The information and sustainability metrics provided by the 3 previous modules and the Renovation Roadmap of the ALDREN BRP (see below) is shared with financial valuation experts who compare the financial impacts – costs, risks, and value – associated with different renovation scenarios.

ALDREN has identified a clear need to better highlight financial benefits of deep renovation related to energy and indoor environment quality (IEQ) performance. A more consistent and detailed information sharing between energy and environmental engineers/consultants on one side and real estate financial experts, banks and financial analysts on the other side could help foster further investment and improve market financing conditions.

The ALDREN methodology for financial valuation – Indicators and information sharing

ALDREN has developed a methodology for financial valuation of renovation action, which focuses on the provision of relevant ALDREN sustainability metrics (energy, IEQ) and detailed technical and performance information about renovation actions to financial analysts. ALDREN specifies indicators and information to be shared alongside the most relevant financial information for building valuation (such as the building’s lease structure or local market data, including rental values, rental growth rates or duration to let).

Reflecting sustainability-related information on financial value and risks strongly depends on local market conditions as well as the property itself and lease terms. Estimating those conditions requires a specific expertise from real estate experts and assessors which is beyond ALDREN’s scope. ALDREN specifies which financial indicators should be collected and taken into account, not how they should be integrated in asset valuations: ALDREN does not override the expertise of qualified real estate experts, financial analysts and assessors who have to follow special legal or professional rules. However, presenting of some partial financial indicators, ALDREN aims highlighting the impact of energy related renovation to all relevant stakeholders involved in decision making process towards deep renovation.

The ALDREN methodology is composed of two parts:

- A list of indicators, including definitions, sources of data and protocols for their calculations. A new risk indicator related to the obsolescence of non-renovated buildings has been introduced.

- A guidance protocol for the incorporation of these indicators into financial valuation studies for renovation decision-making, in close combination with ALDREN’s Renovation Roadmap that identifies renovation actions, packages and steps over time

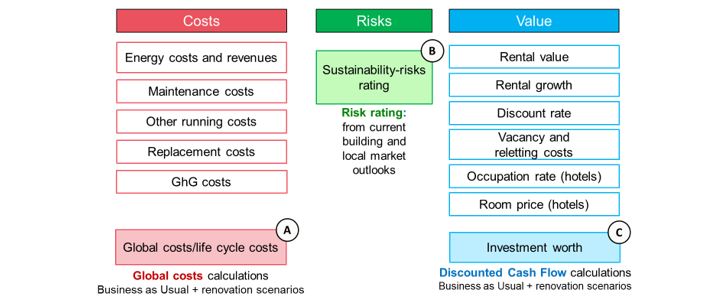

To select the most relevant indicators, three main financial types of direct and indirect benefits from deep energy-related renovation have been identified:

- Global benefits from energy costs savings and potentially extending beyond the energy savings, to encompass reduced maintenance costs and replacement costs in life cycle approach / Direct benefits;

- Asset attractiveness, property value / Indirect benefits;

- Reduced risks for the providers and investors and better conditions for loans / Indirect benefits.

Direct benefits are directly cashed by the occupant or owner: costs savings that can be easily expressed (e.g. energy costs, maintenance costs, replacement costs) and have a direct impact on cash flows.

Indirect benefits result from benefits to other stakeholders: increased asset attractiveness, reduced obsolescence, higher rents and lower risk of vacancy, which result from preferences of tenants and investors and thus also from local market conditions.

This has led to a selection of indicators related to global costs, financial value, and financial risks:

Financial comparisons between renovation scenarios

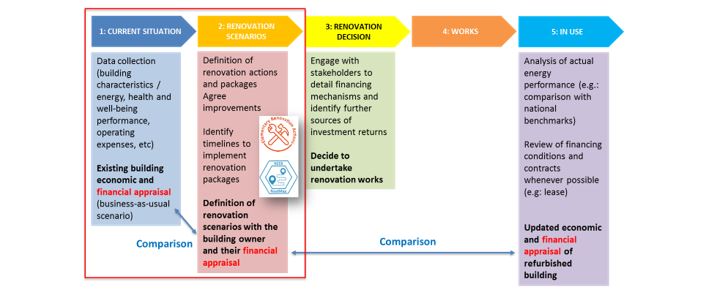

One of the main objectives of ALDREN’s financial methodology is to compare impacts from different renovation scenarios on the financial value of a building, to help owners decide when to invest in deep renovation.

Two main steps are presented in Figure below:

- Initial appraisal, business as usual scenario (Step 1 on Figure 2): appraising the financial value of an existing building if no major refurbishment is undertaken;

- Renovation decision making process (Step 2 on Figure 2): appraising and comparing several deep renovation scenarios. The latter are based on the renovation packages reported in the ALDREN Renovation Roadmap with different scheduling of major renovation steps.

Comparing several scenarios based on the same set of elementary renovation actions and packages answers key concerns: for a given building, is it more interesting to invest in deep renovation now or in 10 years? Is it better to consider deep renovation at once or to plan several successive renovation steps (compliant with deep renovation targets) over time?

Conclusion

ALDREN offers a methodology to better highlight energy, health and comfort topics into financial valuation of building assets, risk appraisal for investors and decision-makers and renovation decisions.

ALDREN helps overcoming three main barriers:

- To address financial market players with their own language;

- To be easily integrated into current building valuation practices;

- To help better integrate sustainability criteria into investment decisions for deeper renovations.

ALDREN’s methodology is transparent and based on a consistent and thorough review of existing reference international financial standards. It may:

- Help increase awareness about environmental issues among financial analysts;

- Provide a new framework for environment-related data analysis;

- In the long term, contribute to shifts in market practices, especially on the financial level.

ALDREN PROJECT

© ALDREN. All rights reserved. Any duplication or use of objects such as diagrams in other electronic or printed publications is not permitted without the author’s agreement.

Read our LEGAL NOTICE – PRIVACY POLICY – COOKIE POLICY.